Introduction

In the age of digital transactions, Venmo has become a popular platform for sending and receiving money with ease. Whether you’re splitting a dinner bill, paying rent to a roommate, or buying goods from a local vendor, Venmo offers a seamless and convenient way to handle payments. The ability to add money to Venmo is a fundamental aspect that enhances the overall convenience and utility of our app. This article of howtowikiguide through the process of adding money to your Venmo account, ensuring you have the funds you need to make hassle-free transactions.

Understanding Venmo and its Features

Venmo is a peer-to-peer payment app owned by PayPal, designed to simplify money transfers among friends, family, and businesses. Users can link their bank accounts or debit cards to the app and add money to Venmo balance. The balance can then be used to send money to others, make purchases, or transfer funds back to their bank account.

Add Bank Account or Debit Card

Downloading the Venmo App

If you don’t have the Venmo app already, download it from the App Store (for iOS devices) or Google Play Store (for Android devices). Install the app and create a Venmo account.

Setting Up Your Venmo Account

When creating your Venmo account, you’ll need to provide essential information such as your name, email address, and phone number. Choose a secure password and complete the account setup process.

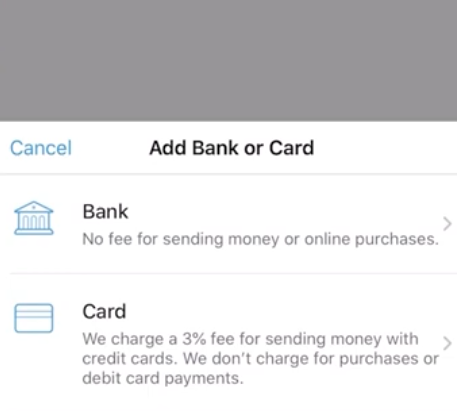

Linking Your Bank Account or Debit Card

To add money to Venmo, you need to link your bank account or debit card. Navigate to the “Settings” menu in the app, select “Payment Methods”.

Follow the prompts to link your preferred payment option securely.

Add Money to Venmo

Adding Money to Your Venmo Balance

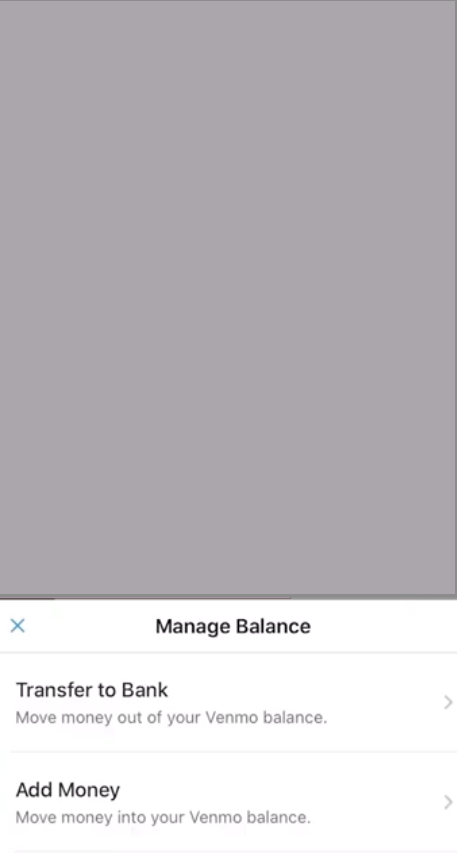

Once your payment method is linked, go to the “Manage” tab in the app.

You have the convenience of instantly transferring up to $500 per week. For larger amounts, Venmo will process the transfer within 3-5 business days.

Select “Add Money.” Simply enter the desired amount you wish to add and select the bank from which you want to make the transaction. The funds will be credited to your Venmo balance.

Venmo Transfer Options

Sending Money to Friends or Contacts

With funds in your Venmo balance, you can easily send money to friends or contacts who also have Venmo accounts. Simply select the recipient, enter the amount, and add a note if desired. Confirm the transaction, and the money will be instantly transferred to the recipient’s Venmo account.

Paying Merchants and Businesses

Many merchants and businesses now accept Venmo as a payment method. When making a purchase, select Venmo as the payment option, and the funds will be deducted from your Venmo balance.

Venmo Fees and Limits

- Adding Money: Generally, To Add Money to Venmo from a linked bank account is free. However, for instant transfers to a linked debit card, a 1% fee (with a minimum fee of $0.25 and a maximum fee of $10) is applied.

- Sending Money: Sending money to friends or family using your Venmo balance, linked bank account, or debit card is typically free. However, please note that using a linked credit card to send money may incur a 3% fee.

- Receiving Money: Receiving money from friends or family is free, regardless of the funding source they use.

- Venmo Weekly Sending Limit: Venmo imposes a weekly sending limit of $4,999.99. This limit includes both payments to individuals and purchases from authorized merchants.

- Venmo Daily Transaction Limit: The daily transaction limit on Venmo is $2,999.99.

- Bank Transfer Limit: When transferring money from your Venmo balance to your linked bank account, the maximum limit per transaction is $19,999.99.

It’s essential to review the fees and limits to understand how Venmo’s services align with your financial needs and transactions. Please note that these fees and limits may be subject to change, so it’s always a good idea to check the latest information on Venmo’s website

Venmo Security and Privacy

Venmo employs encryption and security measures to protect user data and transactions. Ensure you have a strong and unique password for your Venmo account, and enable two-factor authentication for added security.

Tips for Smooth Transactions

- Regularly update your Venmo app to access the latest features and security updates.

- Verify the recipient’s username or phone number before sending money to avoid accidental transfers.

- Keep your payment methods up to date and ensure sufficient funds are available for transactions.

Troubleshooting Common Issues

- If you encounter any issues with adding money or transactions, contact Venmo customer support for assistance.

- Check your transaction history to track and verify payments made.

FAQs

- Is Venmo safe to use? Yes, Venmo employs encryption and security measures to protect user data and transactions. However, it is essential to maintain good security practices, such as using strong passwords and enabling two-factor authentication.

- Are there any charges for adding money to your Venmo account? Adding money to Venmo using a linked bank account is typically free. However, fees may apply for instant transfers to linked debit cards.

- Can I transfer money from Venmo back to my bank account? Yes, you can transfer money from your Venmo balance back to your linked bank account. Standard bank transfers are usually free and take 1-3 business days.

- What should I do if I accidentally send money to the wrong person on Venmo? If you accidentally send money to the wrong person, reach out to Venmo customer support immediately. They may be able to assist in resolving the issue.

- Is Venmo available internationally? As of the article’s writing, Venmo is only available for users within the United States. International transactions are not supported.

Conclusion

The option to Add Money to Venmo account opens up a world of convenient payment options. With the ability to easily send money to friends, family, and businesses, Venmo simplifies financial transactions like never before. By following the step-by-step guide and understanding the app’s features, you can confidently manage your finances with Venmo.